In order to stay financial responsible, many people have turned to a budget checklist as a way to monitor expenses. If you are looking to save the most money and accurately track your expenditures, then perhaps you should incorporate a budget checklist into your daily lifestyle.

Using a Budget Checklist

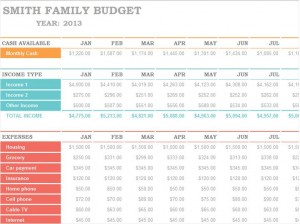

If you are having trouble managing your expenses, you may want to use a budget checklist. Here, you can find a budget checklist that is user friendly and that can work with your lifestyle. This budget checklist is unique because it is free and does not require a subscription. It is also customizable depending on your particular needs and is easy to use.

How to Use the Budget Checklist

On a budget checklist, you can monitor your regular bills. Your first step should be to document all of your expenses for the month. For example, every month you may have to pay either rent or a mortgage. Also, you may have utilities that need to also be paid, which may include gas, electric and a telephone bill. You may have bills related to your car, such as maintenance, fuel and a monthly car payment. You may also have a credit card, which needs to be paid off on a regular basis. All of these items and others should be included in your financial checklist.

Budget Checklist and Due Dates

A checklist can also insure that you pay certain bills on time. For example, you may want to track when each bill is due so that you send payment in ample time. Sending prompt payment can insure that no bill goes into default, thus negatively affecting your credit score.

Saving Your Budget Checklist

Budgeting accordingly will ensure that you will have enough money for all of your monthly expenses in the end. If you stick to the budget, you will not run into any surprises at the end of the month. Budgeting appropriately will also insure that you have some money that you can put into savings, allowing you to accumulate more wealth. Ultimately, a budgeting checklist can help you manage your finances.

Download: Budget Checklist