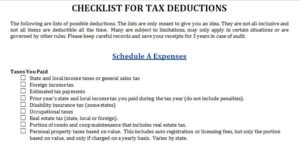

Is tax season getting you down? The free Checklist for Tax Deductions is here to help you organize all the deductions you can possibly apply so you don’t miss out on some less common items. This template is a simple Word document that you can print and check off item by item until you have all your bases covered for tax season.

You will receive items for “Schedule A” items, Business items, and Qualified Medical expenses. In addition, you might have questions that are not featured on any of these lists; these can be filed under the “Expenses You Cannot Deduct” section at the bottom of this template page.

We give you the tools needed to make this tax season as successful as possible for you. To get started, you can read the guide below.

Download and Use the Checklist for Tax Deductions

To download the free template, follow the link at the bottom of this page.

Start by printing the sheet by clicking “File” then “Print at the top of your screen. When you have a physical copy, you can get started on your list of deductions.

You will begin with the “Scheduled A Expenses” These will typically be any payments you’ve made towards you taxes, charity items, interest paid, and other items of the like.

The next section is for “Business Expenses” covers all your bases for operating your own business. You can write off deductions for education, equipment, your home office, and many more items. Most people that work from home don’t know they can write off their internet bills (supposing they need the internet to work).

Medical is another important aspect of your tax deductions. This section gives you the percentage you can deduct from your taxes based on your net income.

Finally, if you scroll toward the bottom of this page, you will see a complete list of items that you can’t deduct from your taxes, leaving no question unanswered.

Download: Checklist For Tax Deductions