You might be wondering if you qualify for the earned income tax credit this year. Some might also be wondering what the EITC even is. The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient’s income and their number of children.

That being said, this is one of the most crucial tax credits to shoot for. You can receive major tax breaks for your children and if you never used this deduction, you might be shocked by what you can get back.

This free template teaches you how to check if you qualify for the EITC.

To get started, just follow the simple guide below.

Using the “Do I Qualify for EITC” Template

To download the free template, just follow the link at the bottom of this page.

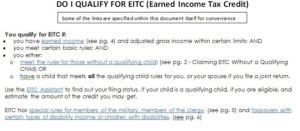

Next, start at the top and go through the list of items provided in this template. By following the first link to see if you qualify for the income limit, you can see where your overall income ranks on the examples given.

Now, proceed to the “Basic Rules” section of the template. You can check off the items that apply directly to your situation.

For your convenience, there are also some additional rules that correspond with the EITC that you might want to learn as well.

In the case that you have qualifying children or in the case you don’t, this template tells you exactly what you need to know.

If you qualify for EITC then this could be your year. This deduction can help take you from owing to earning, download the Do I Qualify for EITC template today to get started.

Download: Do I Qualify For EITC