There are likely many individuals and businesses out there that will need to be prepared to use an IRS Audit Checklist. The IRS may be requesting a number of forms from you, so it can be difficult to keep track of what you might need. You can download an IRS Audit Checklist template to help make sure that you keep everything organized while you file the necessary forms. This can be important, because you won’t want to miss out on sending in anything that they would want to look through. If you have any questions about how to use this IRS Audit Checklist, you may want to read through for some more information.

Basics of the IRS Audit Checklist

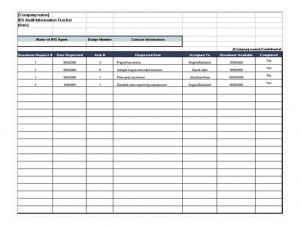

You will want to familiarize yourself with some of the basics of this IRS Audit Checklist. Not everyone will need the same forms and documents as they go through their own audit. But this IRS Audit Checklist can help people keep things organized for themselves and prevent them from missing documents. Take a look at the template that you can download. This IRS Audit Checklist is free and easy to get straight from this website. Once you have downloaded the template, you can feel free to edit the document however you may want.

If you do want to customize your IRS Audit Checklist, you might want to generate a list of essential forms. Take a look at the template to see what is already on there. This will keep you from having to add in duplicate forms or other items. Since this document is fairly easy to customize, it shouldn’t take any time at all to make the changes that you want. You may want to make sure you have a few key items inserted to help you stay organized through this process.

Check to make sure you have the following:

- Statement of yearly earnings

- Tax deductions

- Official forms requested by the IRS

All of these will likely be important components for you to use. Take the time to use this template when are ready to file your Audit to the IRS.

Download: IRS Audit Checklist